When putting together your capital expenditure and reserve funding strategies for the next several years, it’s easy to get bogged down in the minutia. Yes, the details are important, but both landlords and property managers should never lose sight of the forest for the trees.

Don’t put it off.

The first mistake is putting off the effort until tomorrow. There are always more immediate projects that place demands on executives’ time. But a sound capex strategy is a foundational building block of executive decision-making. It gives you a track to run on, and a framework that will illuminate and inform decision-making for years at a stretch.

If you’re muddling through without a capex strategy, or if your capex and reserve funding plan is well out of date, it’s like playing blind-man’s bluff with investors’ money.

No plan written on paper survives contact with reality intact, but you can make adjustments as need be. Get your major strategic initiatives in your planning now, and you’ll be able to flush it out later.

The clock is ticking.

Landlords and property managers have increased their capital expenditures across the country. The same is true in almost every industry across the United States. The reason: The Tax Cuts and Jobs Act – the sweeping tax reform passed by Congress and signed into law by President Trump at the end of 2017 – provides a significant tax incentive for businesses to put the pedal to the metal with regard to capital expenditure.

As a result, capital expenditures are well above where they were just two years ago.

Specifically, the TCJA effectively doubles the bonus depreciation available to those businesses that acquire certain kinds of depreciable capital assets – from 50 percent to 100 percent.

This can make a significant difference in cash flow, after taxes, to any business where there’s never enough cash to fully fund everything we’d like to do from a capital investment point of view – and that’s most of us.

But the provision is only available through 2023 – at which point it will gradually begin to phase out until 2027. So lots of businesses are striking while the iron is hot to put those new assets to work generating revenue as soon as possible.

Property managers that don’t have a plan risk letting competing developers steal a march on them. That may save a few dollars in the short run – but the long-term strategic consequences are devastating: Failing to conceive and execute a capex strategy means getting left behind with out-of-date amenities and conveniences, a loss in market share, and a sub-optimal return on assets as your property loses pricing power in the market place.

More modern, up-to-date properties will drive rent area increases – and you’ll get left out. And with every capex and market cycle, their competitive advantage over you will increase, as their investments drive more and more revenue, long-term. Once they steal a march on you, they’ll they will be able to out-invest you in future capex cycles, and leave you further and further behind.

Why have a Capex?

A sound capex is a critical planning tool that serves each of the following vital objectives:

- It helps prevents getting blindsided by ugly surprises.

- It’s acts as a radar screen to provide early warning of assets that will soon need to be replaced or upgraded and help ensure funds are there to replace them.

- It optimizes medium and long-term revenue potential.

- It preserves safety and health – and thereby reduces potential for liability and risk. For example, your capex plan may include rewiring and electrical upgrades that reduce the risk of power outage or fires.

- It prevents the potentially disastrous underfunding of reserves, and balances prudent reserve funding against the need for investment – ensuring neither priority is neglected.

- It lowers administrative costs in the long run – as short-term decisions can be made more quickly and soundly once a sound capex plan is in place.

- It helps inform both buy- and sell- decisions for asset managers of all kinds.

- It reduces the risk of overpaying income tax (and by combining it with a sound OPEX (operating expenditures) plan, it reduces the risk of accidentally underpaying income tax as well, which can lead to headaches and penalties.

- For property managers, it makes you look good to the landlord. Because it IS good.

As George Patton was fond of saying, the perfect is the mortal enemy of the good. That is, a good plan, put into place and energetically executed now is better than a perfect plan that never gets implemented.

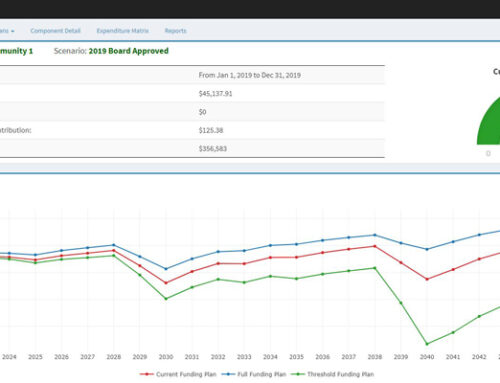

For smaller property managers, it doesn’t make much sense to spend thousands of dollars on high-dollar reserve study and capex consultants at the outset. That’s often not the highest and best use of available capital, when the most pressing capex projects are already known and budgets are limited. Many of the advanced planning tools that were formerly the closely-guarded proprietary secrets of consultants are now readily available to small and medium-sized asset and property managers. New developments in software are transforming the industry, and making it possible for smaller property managers to do much more of their planning in house, with sophisticated tools that make it easy to do basic capex and reserve funding planning in house, saving thousands.

What’s more, with your own reserve funding tools at your disposal, it’s easy to keep your plan updated as circumstances change – without having to go back to a consultant every time.

Don’t let your competitors leave you behind in the capex cycle. Get started today with the help of reserve study software from FJ Strategic.