Community Planning Application Training Modules

These modules will guide you through the process of doing a reserve study. As more modules become available, they will be posted here

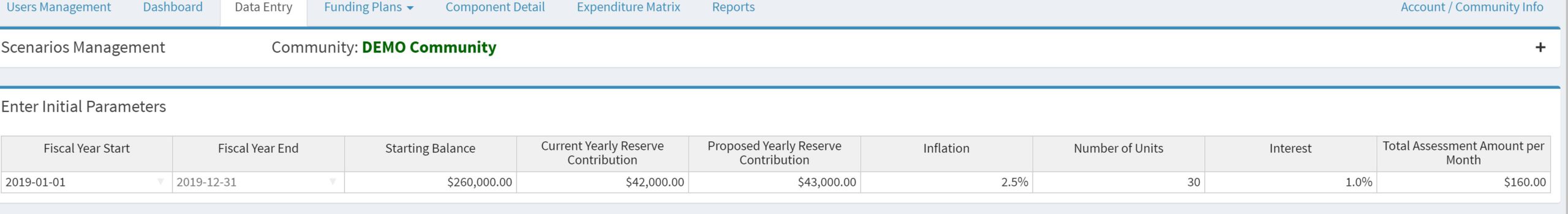

Initial Parameters – The below inputs need to be entered in the initial parameters section

- Fiscal Year Start – Begining of the fiscal year budget

- Fiscal Year End – End of the fiscal year budget

- Starting Balance – amount available at the starting point of the 30-years period

- Current Yearly Reserve Contribution – the reserve contribution that was appropriated before the start of the 30-years period

- Proposed Yearly Reserve Contribution – the amount proposed as the reserve contribution for the first year of the 30-years period

- Inflation – expected inflation rate (%)

- Number of Units – the number of units in the association

- Interest – the planned interest rate

- Total Assessment Amount Per Month – This is the total per unit per month assessment Operating + Reserve, this value is not computed anywhere, just shown on the disclosures

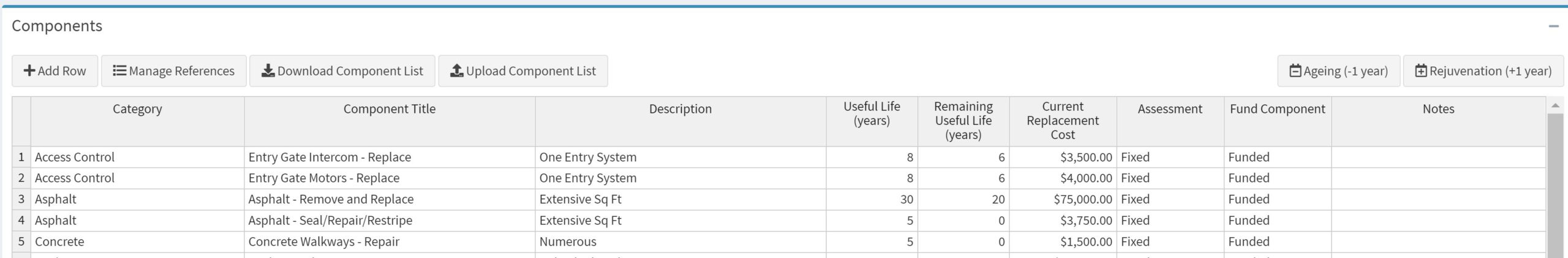

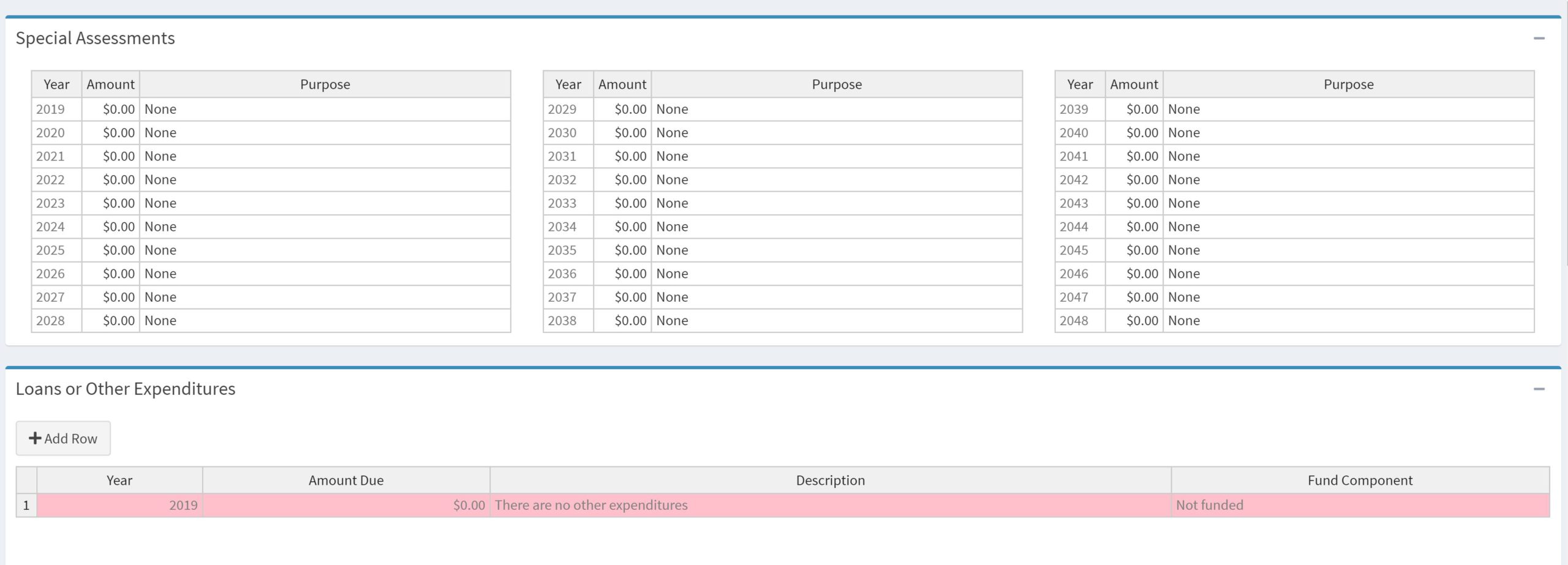

Special Assessments, Loans and other Expenditures can be entered in the applicable tables. Use the “+” button to expand the table. Special Assessments can be added for each of the 30 years in the corresponding tables. The solver treats the entered sums as planned assessments. To add an item into Loans or Other Expenditures, click on the “Add row” button, select the corresponding year and enter the associated information.

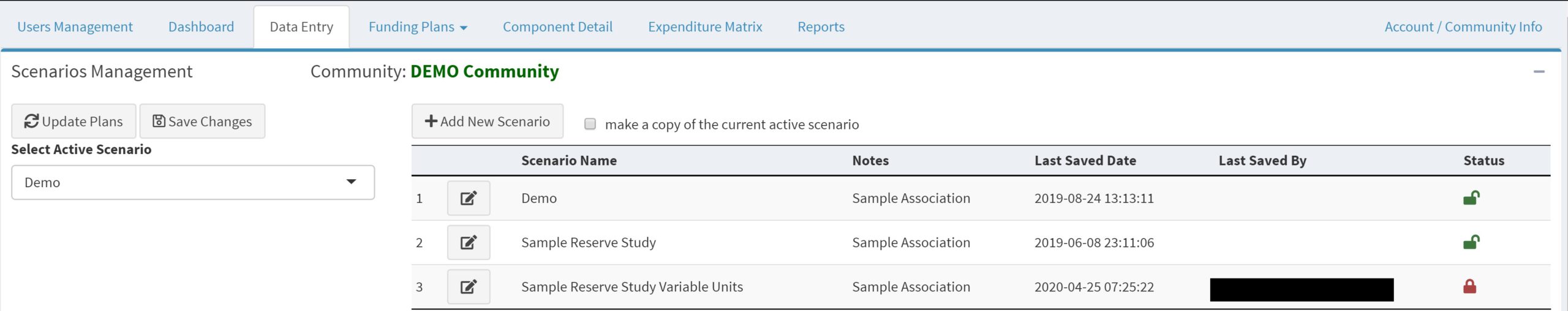

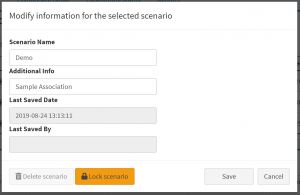

- Multiple scenarios can be created and saved independently by clicking the “Add New Scenario” button

- To copy all the information entered in a previous scenario mark the “make a copy of the current active scenario” checkbox

- Upon creation of scenarios, users can switch between scenarios via the Scenario Dropdown menu

- To lock a scenario click on the edit button, then click lock scenario, this cannot be undone and will prevent any additional changes to that scenario

- To delete a scenario, you must first lock the scenario then click delete scenario

Your Content Goes Here

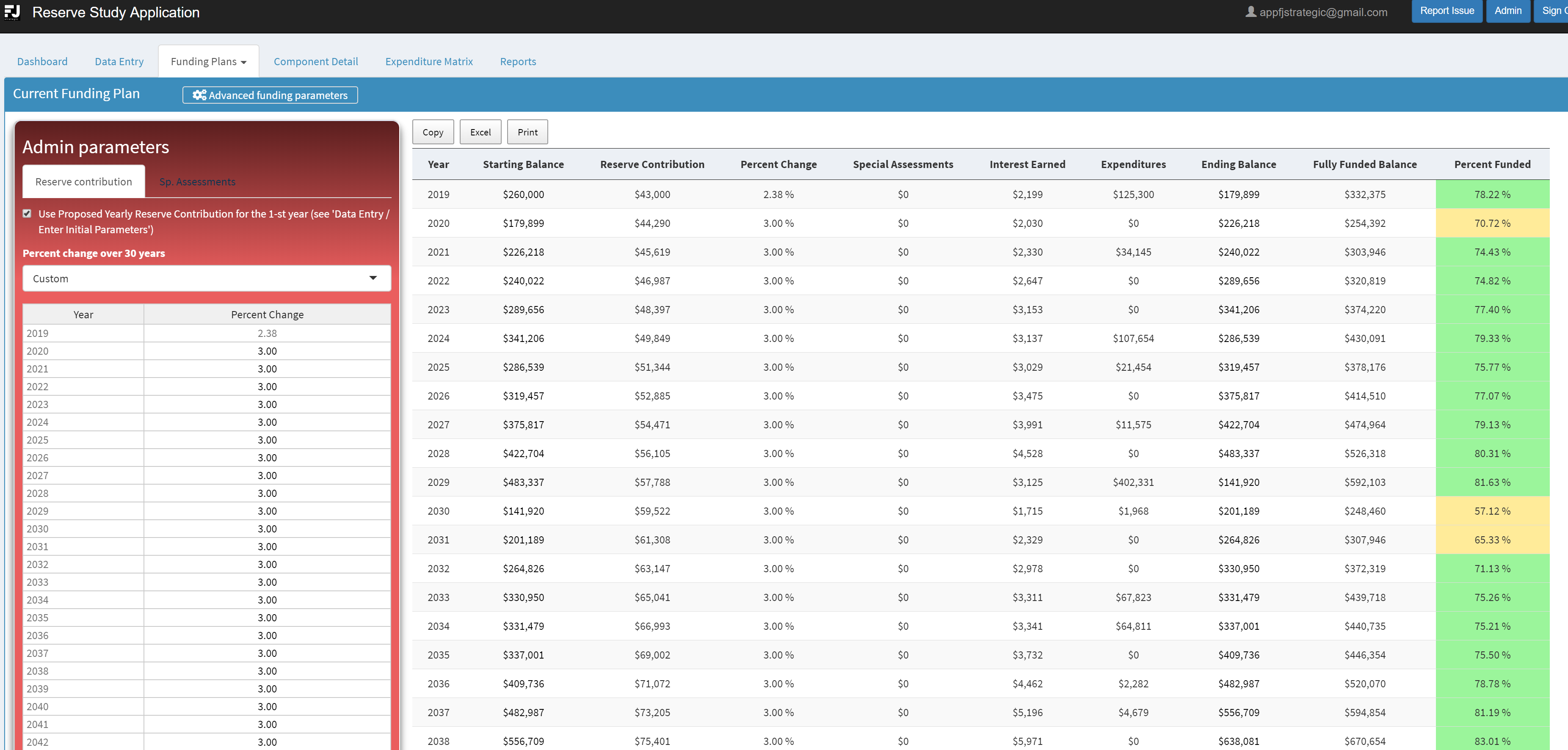

This plan outlines the current situation of an association. Initial parameters from Data Entry tab are used to caculate cash flows for the plan. Advanced funding parameters allows you to fine tune and choose how the yearly reserve contribution should increase year by year.

The Reserve Contribution for the first year can be set in two ways:

- Using the fixed amount form the Initial Parameters (the checkbox ‘Use Proposed Yearly Reserve Contribution …’ is checked)

- Using the value of Current Yearly Reserve Contribution increased by the defined percent of this amount (the checkbox ‘Use Proposed Yearly Reserve Contribution …’ is unchecked). The Reserve Contribution for the next 29 years will be calculated incrementally: Res.Contr. for year 2 = Res.Contr. for year 1 * (100 + Percent Change)%

Percent Change can be chosen either Uniform or Custom. Uniform Percent change means that the Reserve Contribution will be increased every year by the same percent as compared to the previous year. If the Percent Change is set to Custom, then a user can vary the increase in Reserve Contribution for any year.

The Special Assessments for the Current Funding Plan can be adjusted only on the Data Entry tab.

Varying the Initial Parameters and yearly percent change it is possible to develop the funding plan which fits the target goals, e.g. Percent Funded 100% on year 30, always positive Ending Balance, not regular custom reserve contribution for some years, etc.

Alternatively, the Threshold Funding Plan and Full Funding Plan allow achieving the most essential goals without manual search of the appropriate combination of initial parameters, the most of work will be done by internal optimization algorithm of the application.

The Threshold Funding Plan option will be typically selected by the board which could be a specific funded target or a cash balance target. The application will calculate what it takes for an association to always maintain a positive cash flow.

The internal algorithm optimizes cash flows in order to guarantee the following two conditions:

- Positive ending balance for each year

- Ending Balance to Expenditures Ratio for each year exceeds the predefined minimal value (0.1 by default)

The full funding plan option allows an association to always maintain a positive cash flow and to achieve a 100% funding at the end of a 30-year period. The internal algorithm optimizes cash flows to guarantee the following three conditions:

- Positive ending balance for each year

- Ending Balance to Expenditures Ratio for each year exceeds the predefined minimal value (0.1 by default)

- 100% funding at the end of a 30-year period

Initial parameters from Data Entry tab (Starting Balance, Proposed Reserve Contribution, Inflation, and Interest) are used in calculations of the cash flows for the plan.

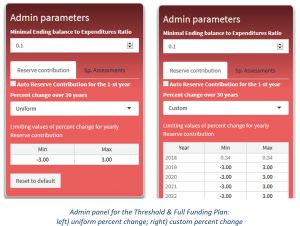

The internal algorithm automatically estimates the minimum required reserve contribution for each year. Special Assessments also can be automatically added by the algorithm for some years in order to guarantee the positive balance during the first several years. The algorithm always try to apply uniform increase/decrease of the reserve contribution from year to year (unless a user specifies other settings in Admin Parameters side panel). Admin Panel allow choosing how the Yearly Reserve Contribution should increase year by year as well as the rules for adding Special Assessments.

Minimal Ratio of Ending Balance to Expenditures can be set to any non-negative value (as a rule, it is a positive value between 0 and 1), it ensures the required level of cash flow considering the variable expenditures from year to year. The default recommended value is 0.1.

Percent Change can be chosen either Uniform or Custom:

- Uniform Percent change means that Reserve Contribution will be increased every year by the same percent as compared to the previous year. A user is asked to set the limiting values of percent change for yearly Reserve contribution. This range is to be used by the algorithm to find the optimal value of the Percent Change. Default range is [-3.00% to +3.00%]

- Custom Percent Change means that a user can set different limiting values for any year. Then the algorithm finds the optimal value of the Percent Change of Reserve Contribution for each year considering the defined limits. Default range is [-3.00% to +3.00%] for years 2 to 20 and [-3.00% to +2.50%] for years 21 to 30

The Percent Change for the first year is always chosen by the algorithm and cannot be changed by a user. A button “Reset to default” resets the limits of Percent Change to the default values. The subtab “Sp.Assessments” in the Admin Panel allows setting the rules adding Special Assessments if they are required by the internal algorithm.

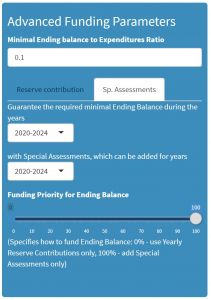

The algorithm can add the special assessments to guarantee the required conditions while ensuring there are not super high yearly reserve contributions. In particular, the special assessments can be added if high contributions are required in the early years. A user is asked to choose the two-time ranges:

- the first one sets the years, for which the required minimal Ending Balance should be guaranteed by additional Special Assessments

- The second one sets the years, for which the Special Assessments may be added

PDF Report

- Disclosures