Here’s a common problem faced by all too many homeowners’ and condominium associations: Boards fail to set membership dues at an appropriate and prudent level. It feels good for a little while, but sooner or later, the inevitable catches up with them: They get blindsided by a major expense, and have to go back to the owners with a special assessment to pay for it.

But worrying about which of your neighbors are delinquent in paying their share of special assessments is looking at the problem through the wrong end of the telescope. Instead, members and boards should focus on preventing the need for future special assessments – and members should hold boards and board members accountable for collections rather than taking it upon themselves to focus on other individual members.

Prevention.

For board members: Most special assessments are the cumulative result of many mistakes.

It’s great if everyone has the cash on hand and happily pays up. But in any association of any size, that hardly ever happens. There are inevitably a few people who won’t or can’t pay. Which puts volunteer board members in the unpleasant position of having to enforce collection from their friends and neighbors.

Special assessments are unjust.

Furthermore, special assessments are inherently unjust. They unfairly impact the family that just bought their home three weeks ago. Meanwhile, the family the new neighbors just bought their home from skates. And families who just bought and furnished a new home aren’t likely to have a lot of cash lying around to pay special assessments.

Boards should consider special assessments a necessary evil: Sometimes you have no choice – but it’s something prudent board members should be executing their utmost efforts and good judgment to prevent.

How to prevent having to do special assessments in the first place.

The best way by far to deal with this situation is to prevent it from happening in the first place. Boards need to take their strategic fiscal planning responsibilities seriously – and avoid the pitfalls and planning mistakes that have plagued other associations and forced them to go the special assessment route:

- Failure to raise dues along with construction material and local labor costs.

- Failure to account for predictable depreciation and wear and tear, necessitating the repair or replacement of major items.

- Failure to maintain adequate insurance. You can’t put hurricanes, earthquakes, tornados and lawsuits on a depreciation schedule. That’s what insurance companies are for.

- Failure to implement adequate controls on financial accounts, opening the door to embezzlement or theft.

All these things can cause associations to fall asleep at the wheel, underfund reserves, and force them into Special Assessmentsville.

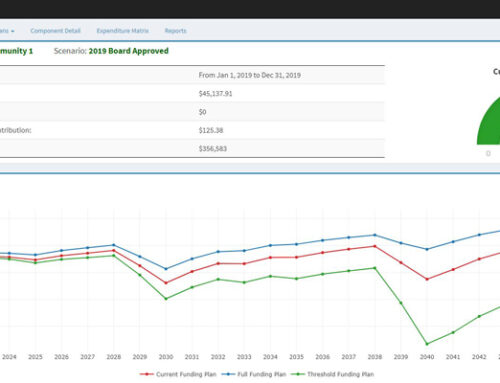

This is why reserve studies are critical to the long-term prosperity of any homeowners’ association or condo association. Not every association is big enough or cash rich enough to spend thousands on bringing in an outside consultant. But even the smallest associations can purchase specialized software to help them conduct their own detailed reserve study and run different scenarios.

It is always much easier to increase regular dues by a small amount than to impose a special assessment for a large one.

Collection.

But once a special assessment occurs, board members need to be firm about collecting it across the board, and be willing to enforce it, to the point of foreclosure, if necessary. Otherwise the injustice compounds.

But is the responsibility of the Board of Directors and the President and their legal counsel, and not the responsibility of any single individual association member. State laws vary, but in most cases, debt collection laws require creditors – including HOAs and condo boards – to maintain privacy. They are generally prohibited by law from publishing or otherwise divulging a personally identifiable list of individuals who are delinquent in paying dues or assessments.

‘Naming and shaming’ can backfire.

Some states permit boards to publish minutes from board meetings that list unit numbers or addresses rather than names (Cohen v. Beachside Two – I Homeowners Association, for an example in Minnesota).

So unless you’re on the board, and you have a fiduciary responsibility to ensure delinquencies are collected, you might not want to know who is delinquent by name. If the Board somehow leaks it to you, and you don’t have a right to know, or publicizes the information, they could sue the Association for violation of privacy. Even if they lose, the legal fees still cost the association money – and that costs you money, indirectly.

If the association loses, it can cost big money.

It also leads to discord among neighbors.

Also, depending on the circumstances and state law, it could easily lead to another member suing you for defamation. Especially if you tell someone else, or they think you told someone else, and you got it wrong.

Focus on systems, not individuals.

Rather than trying to police your individual neighbors, it’s much better to hold boards accountable for the financial condition of the association as a whole. They should be regularly disclosing the status of the assessment, the number of delinquent members and the amount in arears, and be able to discuss the steps being taken to collect them, without violating the privacy of individual members. Stay in your lane, but hold the board’s feet to the fire.

To learn more about how associations can conduct a detailed reserve study without spending thousands on consultants and outside experts, click here.